Ties Between Online Gaming Stocks & Cryptocurrency

The following content is for informational purposes only. The content should not be

understood as constituting.

The Coronavirus pandemic has stirred up perhaps the most inhospitable business

environment imaginable for many industries, with gaming and hospitality assumed to bear

the brunt. Whilst hospitality hasn't stood a chance, gaming as a whole hasn't taken the

beating many all assumed it would. This is in part because online gaming has thrived under

a lockdown environment, with many people forced to turn online for entertainment.

In fact, it could be argued that demand for gaming and entertainment has risen because of

the tough, unsociable times we're in. Instead, it has been the brick and mortar casinos and

resorts that lacked diversification which are struggling.

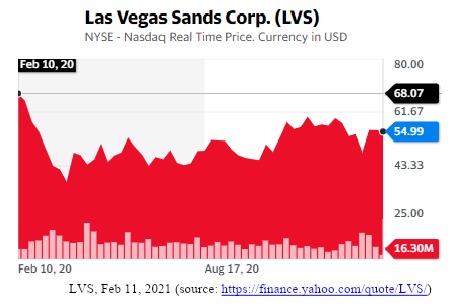

Las Vegas Sands is an excellent example of this. NYSE: LVS was around $70 USD a share

this time last year. After the market crash in March 2020, it has failed to fully recover, sitting

around the $55 mark for several months now. In a pre-coronavirus world, its portfolio would

seem relatively diversified, with casinos, hotels, exhibition facilities, and even a science

museum in Singapore. Of course, in hindsight, these were all under immediate systemic

threat from lockdown.

With something of a surge in online casino usage, we can see stocks climb for companies

that are more digitally focused. NetEnt, a Swedish firm that is responsible for providing

gaming software for companies around the world, has seen exponential gains in its

valuation. In fact, the March market crash was the perfect catalyst for them, along with the

introduction of national social distancing measures. OTCMKTS: NTNTY went from being

around $5 for around 10 months leading up to the March crash to climbing consistently and

reaching $20.

The same goes for Stars Group, Penn National Gaming, and DraftKings. The industry as a

whole has rapidly expanded in much the same way that online content in general has. More

traditional casino companies have faced excruciatingly slow recovery, with their future's

being highly debated. The more traditional companies that have faired well, like MGM

Resorts International, have done so because of their geographical diversification in places

that are no longer in a lockdown, such as China.

Cryptocurrency: A Complimentary Good

The movement away from land-based gaming services to online has been mirrored by the

movement towards digital currency and away from fiat. They're not entirely unrelated,

however, with many online gaming sites accepting cryptocurrency as a means to speed up

transactions and remain relatively anonymous.

This deepens the existential threat for land-based casinos, which will not be able to facilitate

the level of privacy and convenience that customers have been getting used to online. The

gaming industry is only one of many factors that has increased the demand for

cryptocurrency, though.

Given the significant rise in retail investors since the pandemic's inception, we can also put it

down to speculators moving into new, emerging markets. Two years ago, Cryptocurrency

may have been seen as a very alternative investment, but with meme stocks on the rise and

high-risk speculating becoming normalized, cryptocurrency is quickly making its way into a